Protecting your healthcare reputation

Protecting your healthcare reputation through tailored coverage options that meet the needs of your hospital organization or medical practice is important to us. Our team works with you to help ensure your success through timely risk management tools and responding quickly to mitigate your exposure with expert underwriting and claims defense. For more than 32 years, we’ve stood alongside insureds to help mitigate incidents that could affect their liability.

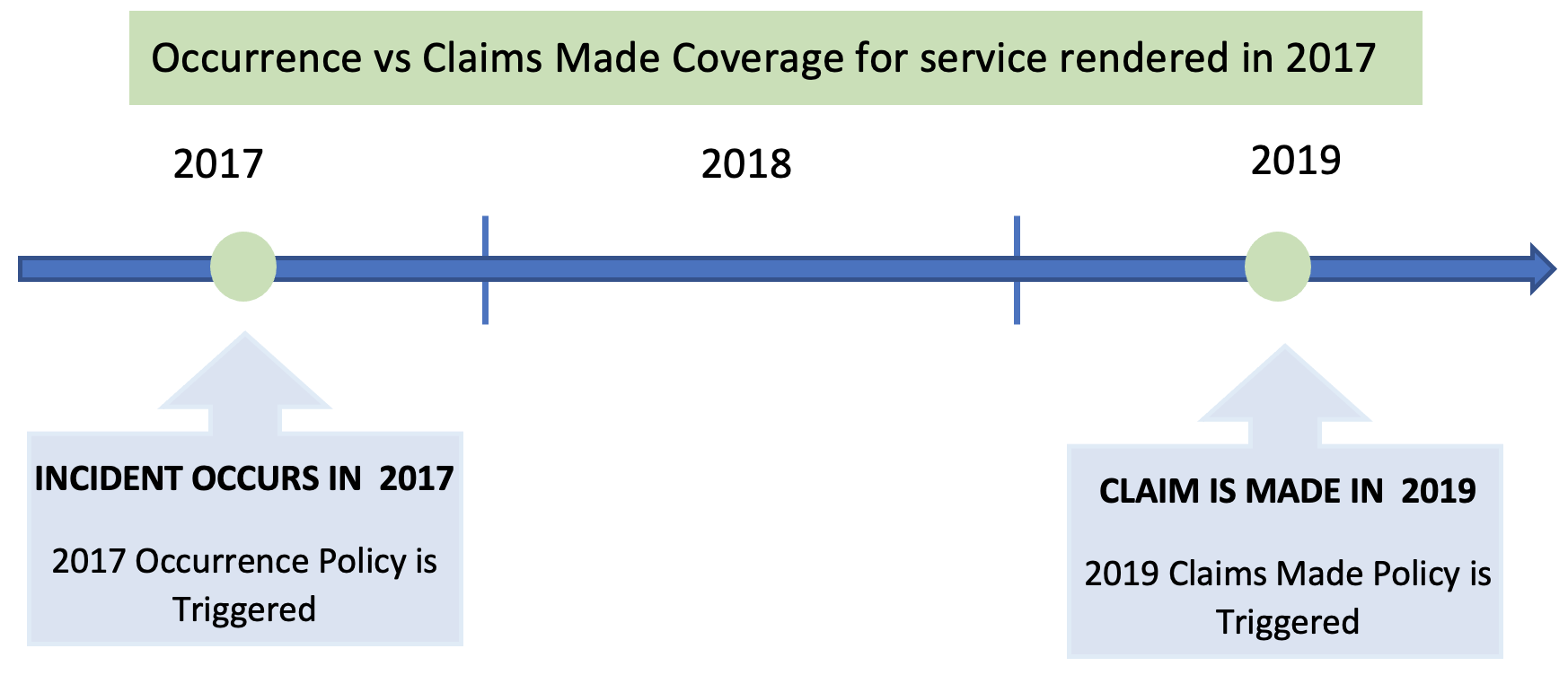

An occurrence policy offers protection for claims arising out of your practice of medicine during a policy period. No matter when a claim is reported, you are covered under the policy in effect at the time of the incident (service rendered).

Claims-made coverage offers protection for claims reported by an insured during the time the policy is in effect, provided the incident happened after your claims-made retroactive date. Usually, this is the date of your first claims-made policy. Continuous renewals of the claims-made policy allow you to report claims for incidents occurring in previous years dating as far back as the initial start date of your policy.

Our claims made coverage also offers the options of Tail Coverage as well as Extended Reporting Periods. If you do not renew a claims made policy, you may need tail coverage to protect yourself against claims submitted after your last policy has expired or been canceled.

Modified Claims Made coverage offers prepaid tail on a claims made basis. This coverage provides an automatic tail, at no additional premium charge, so there is no need to purchase tail once the policy expires or has been canceled.

*for occurrence coverage, claims made coverage and modified claims made coverage

$200,000/800,000

$300,000/1.2M

$400,000/1.6M

$500,000/2M

$1M/4M

$2M/4M

Excess limit options

With Occurrence coverage, limits renew as a separate set of limits each policy year. This means that an incident in one year does not deplete the limits in the following years. Coverage is triggered at the time the incident occurred, not when it was reported, so occurrence policies do not require tail coverage.

Claims made coverage limits remain the single set of limits during the life of the policy; there are not a separate set of limits each year. Coverage is triggered when a claim is made and is reliant on the policies applicable retro date. Tail coverage is required to allow coverage for claims made and reported after the policy termination date.

Other Coverages Offered

Complimentary Policy Enhancements for Physician and Hospital Policies

Physician Policy Enhancements

Coverage that provides protection for a variety of cyber-related exposures including:

MPIE offers at no additional charge to insureds, cyber liability and audit coverage.

Coverage maximum provided at $50,000 per covered breach event, audit, investigation, or disciplinary proceeding including fees and costs incurred by appointed counsel.

A common claim practice used to achieve cost effective resolution of claims that involve the breach of the standard of care causing patient harm.

Coverage that provides shared limits for a specific term for a physician or advanced practice professional who is temporarily substituting for a MPIE insured provider should the insured be absent from his or her regular practice for such occasions as vacation or maternity leave.

Coverage that provides an additional limit for a claim that results in a verdict against an insured for covered damages. Payments of damages under this coverage do not reduce the applicable per claim or policy aggregate limit and are provided per event, per named insured.

MPIE will reimburse a portion of expenses incurred by an insured provider from the request to assist in the investigation and defense of a claims, including actual loss of earnings for attendance at the insured provider’s own hearing or trial.

MPIE will pay for the reasonable costs of responding to an audit of the Insured’s medical billing conducted by the federal, state or local government, or by any private health insurer. MPIE will also pay for the costs of responding to an investigation or disciplinary proceeding conducted by the federal, state or local government, or by a private health insurer, arising out of any allegations of Medicare fraud, Medicaid fraud or other allegedly fraudulent billing activity, made against the Insured.

MPIE will pay for the reasonable costs of responding to any investigation conducted by federal, state, or local government pertaining to a medical or pharmaceutical license, for conduct that would otherwise be covered under the terms of the policy, and during the policy period.

Hospital Policy Enhancements

A common claim practice used to achieve cost effective resolution of claims that involve the breach of the standard of care causing patient harm.

Coverage available to providers insured on a Claims Made policy with a shared limit when they have left the employment of the Insured. This allows the departed provider to have reporting coverage, so long as the Insured has a policy with MPIE or has purchased tail coverage. Coverage is available for the period between the retro date and the termination date.

MPIE will pay for the reasonable costs of responding to any investigation conducted by federal, state, or local government pertaining to a medical or pharmaceutical license, for conduct that would otherwise be covered under the terms of the policy, and during the policy period.

Coverage that provides shared limits for a specific term for a physician or advanced practice professional who is temporarily substituting for a MPIE insured provider should the insured be absent from his or her regular practice for such occasions as vacation or maternity leave.

A no-fault coverage available with General Liability coverage. It is for visitors that are injured at your facility. This coverage can assist with an inquired party’s medical out-of-pocket expenses. It reduces the policy holder’s risk of litigation and defense costs for potential allegations of ordinary negligence and premises liability.